Traders using AI-driven strategies see an average 35 to 45% performance boost compared to traditional methods. Berks Technology builds custom AI trading bots tailored to your strategy.

better performance compared

business with literally zero downtime

custom AI models were delivered

uptime with secure, cloud deployment.

faster execution speed with latency-optimised

We prepare AI-operated trading strategies to conform to your risk tolerance. So, you can rest assured that we don’t pull a one-size-fits-all template. Our best models combine quantitative research and machine learning to create well-developed strategies. Also, our clients have seen improved risk-adjusted returns of up to 40% over manual discretionary trading.

Our quant engineers build smart ML trading models from scratch. Whether you need short-term scaling or support for multi-asset trading, we cover it all. And you can rest assured that your model is fully tested on historical data over several years before we do any live deployment.

We do not deploy a strategy until it is literally tested under each market situation. While employing sophisticated backtesting paradigms and Monte Carlo simulations, we test the strategy against instability, liquidity disruptions, and flash crashes.

Your strategy will not be tied to one platform, we assure you that. We connect bots with 50+ world exchanges and brokers (like equities, forex, and crypto) to trade with accuracy and uptime guarantees.

Markets change, and so does your bot. We keep it up-to-date. Our platforms regularly retreat and fix your trading model with real -time market data. From auto-scaling environment to latency optimisation, we keep the performance at the forefront.

We collaborate with you and provide continuous assistance. Your bot is constantly subject to our support team, with 24/7 continuous monitoring for API updates. It develops compatibility, exchange rules change compliance, and market dynamics. We make sure you control everything with a detailed performance report.

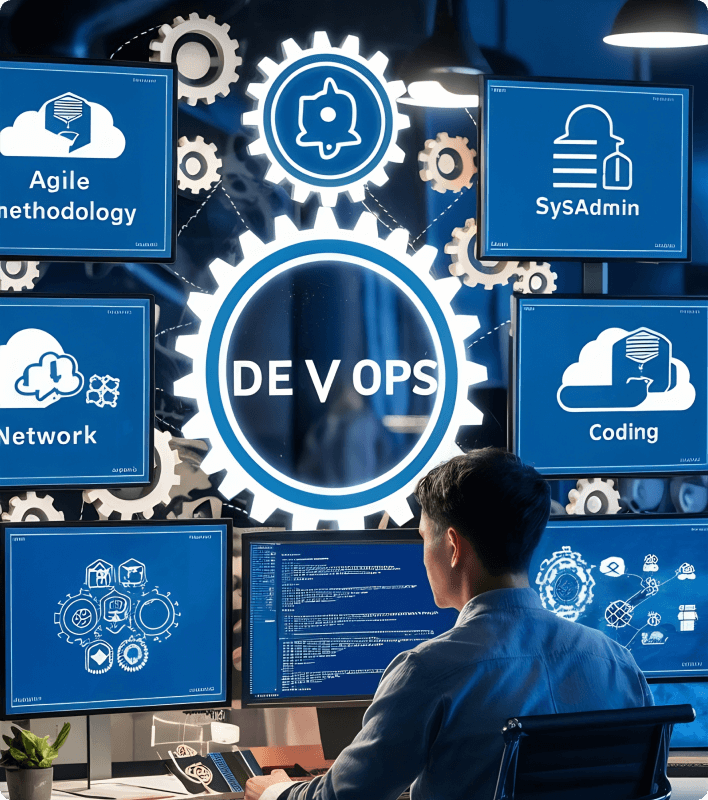

We start by understanding your trading vision deeply. It covers markets, timeframes and risks in depth. Our top quant researchers chart opportunities where AI and machine learning could improve human execution.

Our engineers lay the foundation of your personal AI bot. We can say that a low-latency, scalable infrastructure is primed for machine learning operations. Prototypes, system designs and dashboards allow you to approve strategy flow as you want.

We build your trading bot on CI/CD pipelines and up-to-date ML framework (Tensorflow, Pytorch, Scikit-learn) to iterate quickly without any compromise on stability. Each sprint sees tangible progress supported by solid testing.

Your AI bot is then integrated between exchanges, brokers and data feeds, and stress tested in real- world conditions. We ensure the speed of execution, slippage and model performance verification before the sign-off.

We roll out your AI strategy bot into production with a 99.9% uptime guarantee, which is powered by clock monitoring and automatic scaling. As the markets change, we continuously fine-tune your models to keep you in the lead.

Start with what you need, customize as you go.